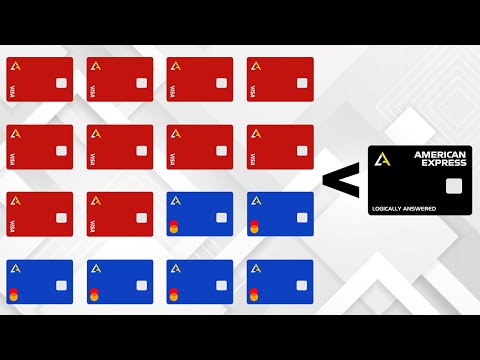

We’re all familiar with the names American Express, Visa, and MasterCard. Those of you looking to maximize your rewards and points often prefer Amex due to its superior rewards programs. But aside from that, there’s little difference between these card networks from the consumer’s side. From the business side though, the difference between Amex and the other two is massive. Visa and MasterCard have issued 20 times as many credit cards as Amex, yet Amex boasts the same revenue as Visa and MasterCard combined. The only explanation for this is that Amex charges higher fees to merchants and Amex customers spend a lot more money than Visa and MasterCard customers. Ever since American Express entered the card business, they have targetted high-end spenders which they like to call spend-centric. Over the years, this has proven extremely lucrative for Amex as they’re able to pull in higher fees from merchants on their highest spenders. This video explains the story of American Express and how they grew to be the king of credit cards.

Earn Interest From The Government & Top Corporations:

(iOS App for US Residents)

https://www.silomarkets.com/waiting-list-page

Socials:

https://www.instagram.com/hariharan.jayakumar/

Discord Community:

https://discord.gg/SJUNWNt

Timestamps:

0:00 - American Express

2:35 - Humble Roots

4:51 - Financial Services

6:33 - The Great Winter

8:28 - Credit Cards

10:22 - Amex Today

Thumbnail Credits:

https://bit.ly/3pZbzdU

Resources:

https://pastebin.com/b73KDaGX

Disclaimer:

This video is not a solicitation or personal financial advice. All investing involves risk. Please do your own research.

https://www.silomarkets.com/disclosures